Unlocking Opportunities: Exploring the World of Forex Futures Trading

Why FX Traders Are Transitioning to Forex Futures

Forex futures offer a streamlined and impactful alternative for navigating the traditional FX spot market, with advantages such as:

Well-regulated marketplace

Transparent pricing and volume

Trading on a fair and level playing field

Benefits Of Trading Forex Futures Over Spot Forex

✔ Fair And Regulated Markets

Futures markets and brokers are highly regulated, with all transactions generally consolidated at one exchange. The advantage of a centralized exchange is that orders are matched and guaranteed to be settled. There's also full transparency to contract pricing and volume, allowing large and small traders to compete on a level playing field.

Alternatively, there's no centralized exchange for spot FX transactions as they're fragmented across various unrelated forex dealers often with little or no price and volume cross-reporting. These trades often occur on a broker’s dealing desk with no counterparty guarantees.

✔ Consistent Cost To Trade

In the forex futures market, traders generally pay a commission per contract, but often the true cost of the trade is expressed in the bid/ask spread, which is set by supply and demand and the available liquidity. Most forex futures markets have good liquidity and consistently tight spreads, enabling traders to enter and exit trades efficiently and cost-effectively.

With spot FX, the bid/ask spread is often set by a broker and is used to help manage the broker’s risk and drive overall profitability. A spot FX broker can take the other side of a trade, transition it to a wholesale pool, and lock in a profit. This is why spot FX traders often start a trade with a negative P&L. Additional fees for spot FX can include per-trade commission and overnight interest rate carrying costs.

✔ Diversification

Why limit what you can trade? While spot FX traders are often limited to trading one currency against another, futures trading offers a wider range of products to diversify and capture unique market opportunities. With futures, you can trade major market indexes, interest rates, gold and silver, crude oil and natural gas, agricultural products, and currencies.

Advantages Shared By Forex Futures And Spot FX

Why Choose Tradovate?

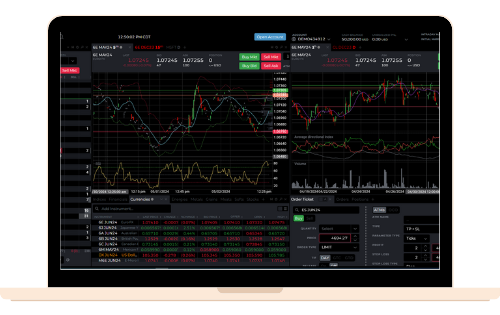

Trade Anywhere, From Any Device

Get full access to all versions of Tradovate’s cloud-based platform to trade on all your devices: desktop, mobile, tablet, Mac and PC.

40+ Advanced Trading Tools

Designed specifically for futures traders, this suite of tools was built for the modern markets. Identify and execute your next trade with advanced Tradovate tools.

.png?width=50&height=50&name=funding%20(1).png)

Transparent Pricing: No Hidden Fees

Choose from three different plans designed for the way you trade.

Safe & Secure

Our cloud-based trading system has the latest 2FA account security.

FX Futures Product Overview

Watch

Get a high-level overview of the FX market and examine important concepts you should understand when trading FX futures in this video from CME Group.

Read

For more information about FX futures, including fundamentals and key features, contract specifications, tick size and more, check out the CME FX Futures and Options brochure.

Choose a Pricing Plan that Fits Your Trading Style

Trade with no commitment per side pricing or upgrade at any time to potentially lower your trading costs further

Free

No commitment, pay a commission only when you trade

$0.39 Micros

$1.29 Standard

$0.20 Nano & Event Contracts

Commission per side

No Monthly Fee

Monthly

Reduce your per trade commissions

$0.29 Micros

$0.99 Standard

$0.15 Nano & Event Contracts

Commission per side

$99/month

Lifetime

Lowest commissions

$0.09 Micros

$0.59 Standard

$0.05 Nano & Event Contracts

$1,499 one-time payment

All plans include access to advanced tools

Every plan also includes access to the following tools, so you can fully customize the way you trade futures:

- Powerful charts: Advanced yet easy-to-use charting tools that help you analyze the markets like a pro

- Third-party tools integration: Seamlessly connect with your favorite third-party trading tools like TradingView and customize your experience

- Free simulated trading: Test strategies and practice risk-free before you trade live in a full-feature simulated trading experience

- Choice of trading accounts: Choose the account type that fits your goals. We offer individual, joint, retirement and business accounts

- Customer support: Get support when you need it including a 24x5 technical support and a 24-hour emergency trade desk

- Low margins: Low intraday margins mean more buying power and flexibility to efficiently deploy your capital

- Customize your trading platform: Choose from hundreds of third-party tools, custom indicators, and automated trading strategies from our community of traders.

- Optional plan upgrade: Pick and choose upgrades to help you trade more strategically.

ALL TRADOVATE PLATFORMS INCLUDED WITH NO LICENCE FEES

Exchange, clearing, and NFA fees still apply.